Sun Feb 01 06:20:00 UTC 2026: ### India’s Semiconductor Ambitions Drive Investment Opportunities in 2026

The Story:

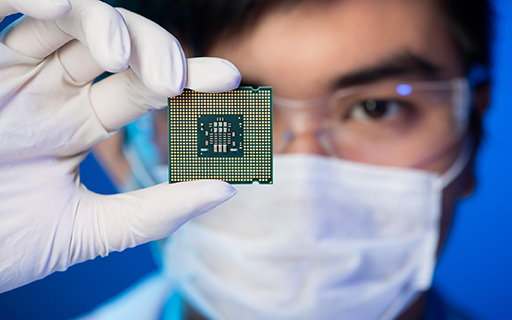

India’s push to establish itself as a global semiconductor hub is attracting attention as several companies gear up for significant operations in the coming years. The primary article highlights four stocks poised to benefit from this growth: CG Power and Industrial Solutions, Bharat Electronics, Kaynes Technology India, and Tata Elxsi. These companies are making strides in areas such as OSAT (Outsourced Semiconductor Assembly and Test) facilities, semiconductor design, and collaboration with international tech firms, all supported by government initiatives like the India Semiconductor Mission (ISM).

Key Points:

- CG Power and Industrial Solutions: Through its subsidiary CG Semi, the company is investing over Rs 76 billion over five years to develop two OSAT facilities in Sanand, Gujarat, with commercial production expected in 2026.

- Bharat Electronics: Exploring collaboration opportunities with Tata Electronics in semiconductor fabrication (Fab), OSAT, and design services, aiming to meet the growing demand for microcontrollers and systems-on-chip. Reported revenue growth of 24% YoY for the December 2025 quarter.

- Kaynes Technology India: Achieved a milestone by producing India’s first commercially manufactured multi-chip modules (MCM) at its OSAT facility in Sanand, Gujarat, in October 2025. Reported consolidated net sales of Rs 9,062 m for Q2 FY26.

- Tata Elxsi: Involved in semiconductor-related engineering and design services, supporting semiconductor systems and embedded hardware. Reported revenues of Rs 9,535 m in Q3 FY26.

- The Indian government aims to be among the top global semiconductor nations by the end of this decade.

Critical Analysis:

The timing of this report, within days of Budget 2026 which allowed foreigners to buy Indian stocks directly, suggests a strategic effort to attract foreign investment into India’s burgeoning semiconductor sector. Peter Thiel selling Tesla and buying consumer electronics stock shows a confidence in the growth of consumer electronics.

Key Takeaways:

- India is making tangible progress in developing a domestic semiconductor ecosystem.

- Government support through initiatives like the ISM is crucial for attracting investments and fostering growth.

- Companies are focusing on mature and mid-range technologies as a stepping stone to more advanced semiconductor capabilities.

- The semiconductor sector represents a significant growth opportunity for Indian companies.

- Foreign investment may be incentivized by new financial regulation.

Impact Analysis:

The growth of the semiconductor industry in India has the potential for long-term economic and strategic benefits. Reducing import dependence and becoming a global player will strengthen India’s position in the global technology landscape. This can further lead to job creation, technological innovation, and increased exports, fostering overall economic development.