Sat Jan 31 17:10:00 UTC 2026: ### Crypto and Metals Plunge Amidst Fed Chair Nomination and AI Investment Concerns

The Story:

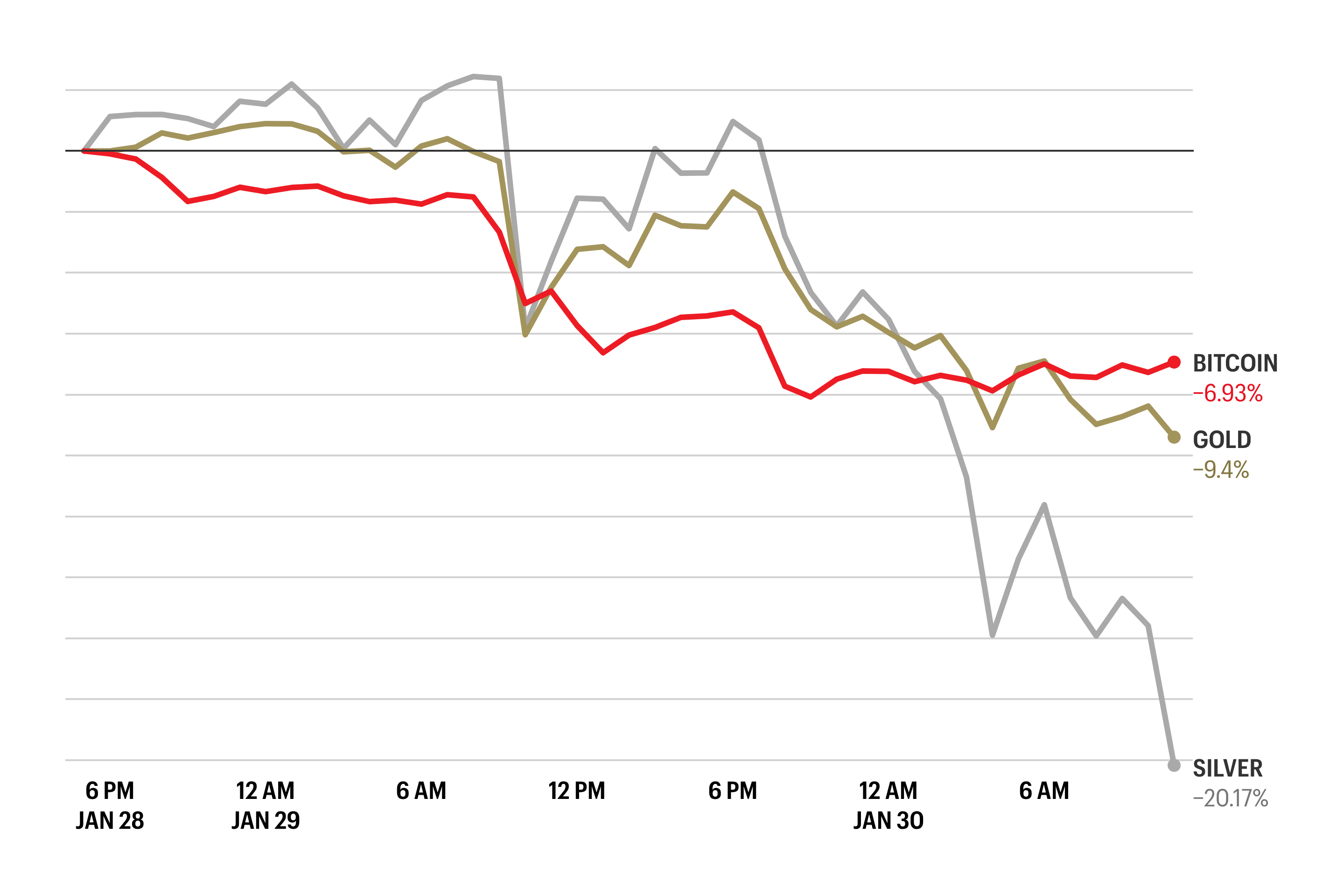

Cryptocurrencies and precious metals experienced a significant downturn, with Bitcoin hitting its lowest price since April, dropping nearly 2% to around $81,000 before a slight rebound to $82,290. Ethereum followed suit, declining 4%. Precious metals suffered even more dramatically, with gold falling 11% and silver plummeting 31%. These market movements coincide with President Donald Trump’s nomination of Kevin Warsh as the new Federal Reserve chair and investor anxieties surrounding Big Tech’s substantial investments in artificial intelligence.

Investor uneasiness stems from the combination of increased AI spending by tech giants like Microsoft, without immediate corresponding earnings, coupled with Trump’s previous tariff threats, which triggered a crypto market “flash crash” back in October.

Key Points:

- Bitcoin fell to its lowest price since April, briefly dipping below $81,000.

- Ethereum also experienced a significant decline, down 4%.

- Gold prices dropped 11%, while silver plunged 31%.

- Donald Trump’s nomination of Kevin Warsh as Fed Chair coincides with the market downturn.

- Investor anxiety over Big Tech’s AI investments is contributing to market instability.

- Trump’s prior tariff threats in October preceded a “flash crash” in the crypto market.

- Bitcoin has diverged from the S&P 500 over the past three months, underperforming significantly.

Critical Analysis:

The confluence of events suggests a complex interplay of factors influencing market sentiment. Trump’s nomination of Kevin Warsh, perceived as potentially altering monetary policy, injects uncertainty into the markets. This uncertainty is compounded by anxieties regarding the sustainability of Big Tech’s AI investments, creating a risk-off environment. The historical context provided shows a clear downward trend for Bitcoin in late January 2026. Given the volatility of the crypto market, any slight shock can lead to precipitous declines.

Key Takeaways:

- Political and economic uncertainty, particularly related to Federal Reserve leadership and trade policy, can significantly impact crypto and precious metals markets.

- Investor sentiment regarding Big Tech’s AI investments is a critical factor influencing market stability.

- Bitcoin’s divergence from traditional market indicators like the S&P 500 suggests increasing sensitivity to specific crypto-related factors.

- The crypto market remains highly volatile, prone to rapid declines triggered by various economic and political factors.

- The market may be entering a “Crypto Winter”, although some see opportunities amid regulation.

Impact Analysis:

The current downturn could have significant long-term implications. A sustained period of lower crypto prices could reduce investor confidence, potentially slowing adoption rates and hindering the growth of the crypto economy. The impact on precious metals could be significant depending on how long investors view the risk off environment. However, increased regulatory clarity and the development of stablecoins might mitigate some of the negative effects. The appointment of the next Fed Chair will significantly dictate both monetary and fiscal policy that can effect the markets and should be watched closely to determine if it is a short-term blip or a long-term strategy.