Fri Jan 23 17:30:00 UTC 2026: ### Gold and Silver Prices Skyrocket Amid Geopolitical Tensions and Trump’s Legal Battles

The Story:

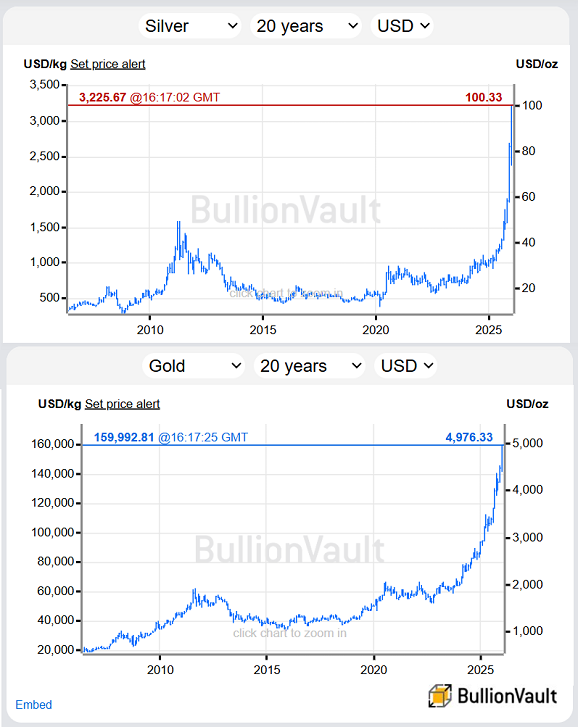

Gold and silver prices surged to record highs on Friday, January 24, 2026, driven by a weaker dollar and escalating geopolitical tensions. Gold approached $5,000 per ounce, while silver surpassed $100 per ounce for the first time. The surge coincides with former US President Trump suing J.P.Morgan for $5 billion and heightened concerns over economic integration being weaponized by global powers, as highlighted by Canadian Prime Minister Mark Carney at the World Economic Forum.

Key Points:

- Gold reached $4987 per Troy ounce in London trading, a 7.1% increase from the previous Friday.

- Silver rose for the 9th consecutive week, reaching nearly $99, a 13.7% gain. Spot trading pushed it past $100.

- Comex gold futures topped $5000 for settlement between April and August.

- Trump sued J.P.Morgan for $5 billion, alleging disruption of his business affairs.

- Mark Carney warned about the use of economic integration as weapons.

- Shanghai gold reached ¥1,110 per gram, a 14.1% increase in 2026. Silver hit ¥24,965 per kilo, up 46.8% since New Year’s Eve.

- Platinum prices are also at record highs, increasing 33.4% this year.

Critical Analysis:

The surge in precious metal prices appears to be a direct response to geopolitical instability and a weakening US dollar. Trump’s lawsuit against J.P.Morgan, combined with his unorthodox foreign policy moves like creating the ‘Board of Peace’ and trade disputes, likely contribute to market uncertainty, driving investors towards safe-haven assets like gold and silver. Carney’s warning about economic warfare reinforces these concerns, painting a picture of a fragmented global economy where traditional financial institutions and currencies are losing their perceived stability.

Key Takeaways:

- Geopolitical uncertainty is a major driver of precious metal prices.

- Trump’s actions, both politically and legally, are contributing to market volatility.

- The weakening dollar is bolstering demand for gold and silver.

- China’s strong demand for silver suggests a regional economic dynamic influencing global prices.

- The record trading volumes in Shanghai highlight the increased interest and price premiums for gold and silver in Asia.

Impact Analysis:

The rise in gold and silver prices could have several long-term implications:

- Increased Investment in Precious Metals: Investors seeking safe havens may further drive up demand, potentially leading to sustained high prices.

- Inflationary Pressure: Higher commodity prices can contribute to broader inflationary pressures, affecting consumer prices and economic stability.

- Shift in Global Economic Power: China’s growing influence in the gold and silver markets could signal a shift in economic power away from traditional Western financial centers.

- Geopolitical Realignment: Trump’s ‘Board of Peace’ and trade policies suggest a potential realignment of global alliances, impacting trade flows and economic stability.

- Financial System Distrust: The lawsuit against JP Morgan, as well as the warnings of using economic integration as weapons, may signal a wider sentiment of distrust of traditional financial systems, which will in turn drive people to seek more secure and independent assets.