Tue Jan 06 10:00:00 UTC 2026: Headline: IEX Shares Surge as APTEL Resumes Hearing on Market Coupling Mandate; Counsel Challenges Power Grid Report

The Story:

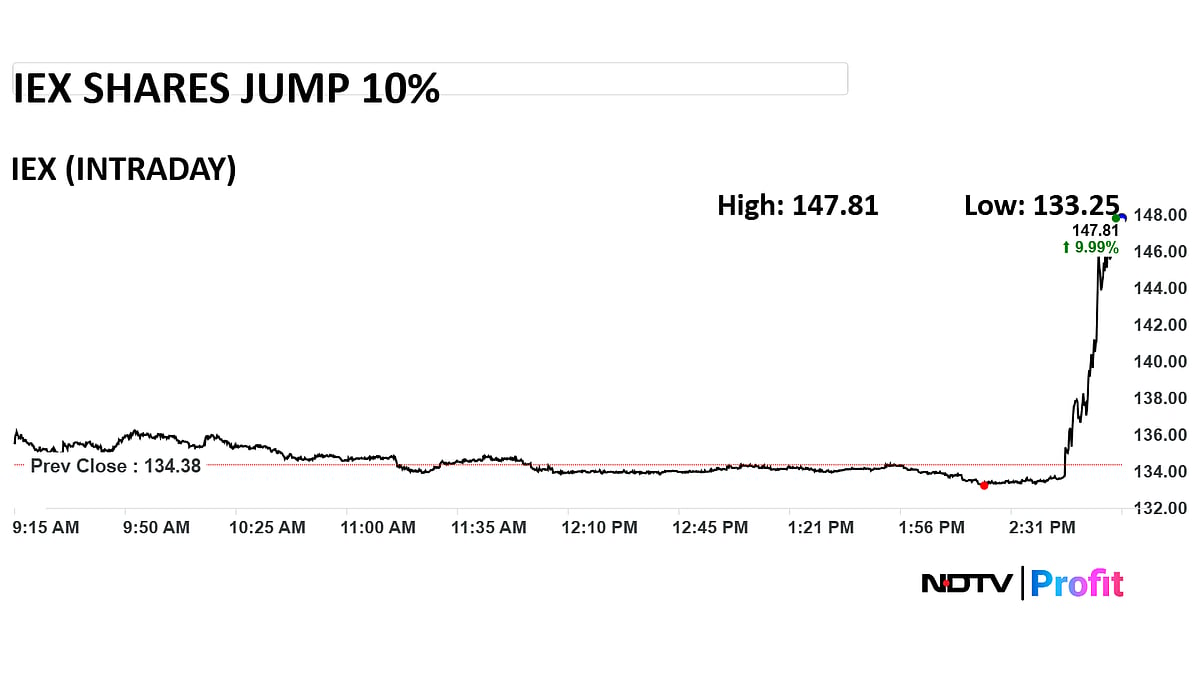

Shares of Indian Energy Exchange Ltd. (IEX) experienced a significant upswing in late trading as the Appellate Tribunal for Electricity (APTEL) resumed its hearing on the controversial market coupling mandate. The stock price jumped to Rs 147, reflecting a 10% gain compared to Monday’s closing price of Rs 134. This surge coincides with vigorous arguments from IEX’s legal team, challenging the procedural integrity of a key report submitted by Power Grid.

The core of IEX’s argument centers on the fact that Power Grid’s report, purportedly submitted in early January 2025, has not been disclosed to the exchange. IEX’s counsel asserts that the report, based on ‘historical data,’ lacks current justification for the Central Electricity Regulatory Commission’s (CERC) decision to proceed with market coupling. The proposed market coupling could threaten IEX’s dominant 85% market share by enforcing a single clearing price across all power exchanges. Adding to investor optimism, IEX also released a positive business update for Q3 FY26, revealing a 12% year-on-year increase in total electricity traded volume, reaching 34.08 billion units.

Key Points:

- IEX shares jumped 10% to Rs 147 following the resumption of the APTEL hearing on market coupling.

- IEX’s legal counsel raised objections regarding a Power Grid report allegedly not shared with the exchange.

- The disputed report is reportedly based on ‘historical data,’ challenging the CERC’s rationale for market coupling.

- Market coupling could erode IEX’s dominant 85% market share.

- IEX reported a 12% year-on-year increase in electricity traded volume in Q3 FY26, totaling 34.08 billion units.

Critical Analysis:

The events unfolding around IEX and the market coupling mandate reflect a significant power struggle within the Indian energy sector. The timing of the APTEL hearing and the associated stock price movement suggest that investors are highly sensitive to any developments that could impact IEX’s market position. The fact that IEX’s counsel is aggressively challenging the procedural validity of the Power Grid report indicates a strategic effort to delay or even overturn the market coupling mandate. This is further underscored by the historical context provided, which shows that IEX shares rose sharply on similar APTEL-related news just days prior (January 6, 2026).

Key Takeaways:

- The market coupling mandate poses a significant threat to IEX’s market dominance.

- Procedural challenges and legal arguments are being used to contest the implementation of market coupling.

- Investor sentiment towards IEX is heavily influenced by APTEL’s decisions regarding the market coupling mandate.

- The lack of transparency regarding the Power Grid report raises concerns about the fairness of the regulatory process.

- IEX’s strong Q3 FY26 performance provides a buffer against the potential negative impact of market coupling.

Impact Analysis:

The resolution of the market coupling issue has far-reaching implications for the Indian energy market. If implemented, market coupling could lead to increased competition and potentially lower electricity prices for consumers. However, it could also negatively impact IEX’s profitability and market share. The APTEL’s decision will likely set a precedent for future regulatory interventions in the energy sector, influencing the balance of power between market participants and regulatory bodies. A favorable outcome for IEX could solidify its position as the dominant player in the energy exchange market, while an unfavorable outcome could trigger significant restructuring within the industry.