Mon Aug 18 04:20:00 UTC 2025: Okay, here’s a summary of the text and a news article based on it:

**Summary:**

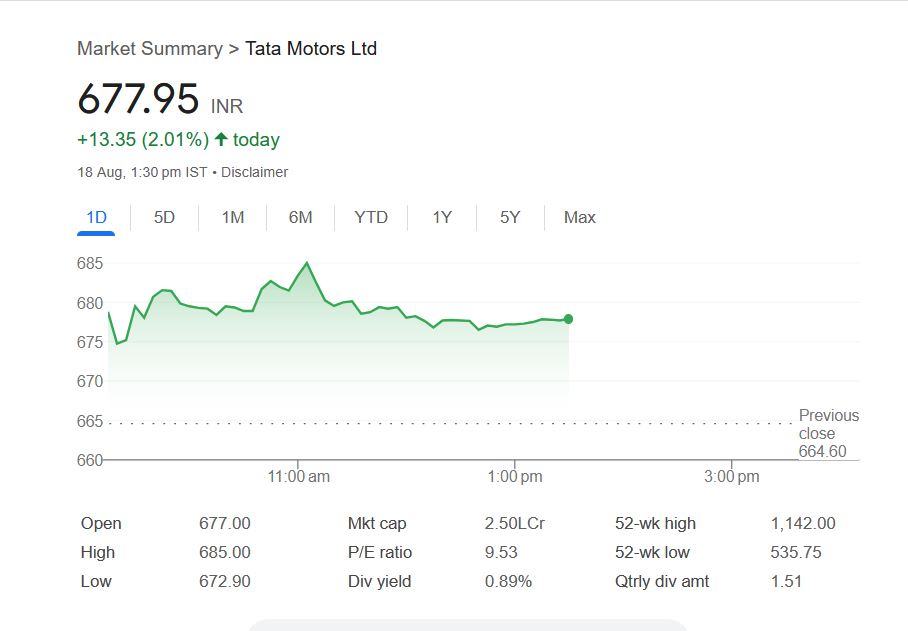

On August 18, 2025, the Indian stock market (BSE and NSE) showed positive momentum. Tata Motors’ stock also experienced a rise, trading at ₹677.95, up 2.01%. While the stock is below its 52-week high, it’s above its 52-week low. Over the past year, the stock has shown negative returns, but it has grown significantly over the past five years. Financial analysts at Yahoo Finance recommend a “HOLD” rating for Tata Motors, with a target price of ₹1300, suggesting a potential upside of over 90%. However, investors are reminded that stock market investments carry risk.

**News Article:**

**Tata Motors Stock Shows Strength, Analysts Predict Potential 90% Upside**

**Mumbai, August 18, 2025** – Tata Motors [NSE: TATAMOTORS] shares saw positive movement today, buoyed by a strong showing in the broader Indian stock market. As of 1:30 PM today, the stock was trading at ₹677.95, a 2.01% increase. The BSE Sensex was up by 1.02% and the NSE Nifty by 1.17% during the same time.

The stock opened at ₹677.00 and touched an intraday high of ₹685 and a low of ₹672.90. While the stock is currently trading -40.32% below its 52-week high of ₹1142, it is up 27.22% from its 52-week low of ₹535.75.

Despite a challenging year, with the stock showing a -37.68% decline over the past 12 months and a -9.52% year-to-date decrease, longer-term performance remains robust. The stock has seen a 42.64% jump over the past three years and an impressive 460.71% increase over the last five years.

Analysts at Yahoo Finance currently have a “HOLD” recommendation on Tata Motors, setting a target price of ₹1300. This suggests a potential upside of 90.73% for investors. The company’s market capitalization stands at ₹2,50,890 crore, with total debt of ₹71,540 crore. Average daily trading volume over the last 30 days has been 64,60,631 shares.

**Disclaimer:** Investors are reminded that stock market investments are subject to market risk. Prices of shares and other financial instruments can fluctuate based on market conditions, economic factors, and other variables. Investing involves the potential for capital loss. This article is for informational purposes only and should not be considered investment advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.